COVID-19 - A Message to our Customers

As the COVID-19 pandemic continues, the world around us is rapidly changing. While many things may be changing, our commitment remains the same as it has for the last 130 years - to continue our tradition of trust to our customers and remain fully operational and ready to assist you.

Our hearts and thoughts go out to those who have been affected by this unprecedented event, and we truly appreciate the healthcare workers, our local communities and governments worldwide who are on the front line working to contain this virus. Farmers State Bank continues to do its part to help the country in slowing the spread of the pandemic, and we want to ensure our customers that we are monitoring the developing situation and have resources in place to provide you continued service in any type of contingency situation.

SBA Paycheck Protection Program

On April 23, 2020, the House passed and President Trump is expected to quickly sign into law the Paycheck Protection Program and Health Care Enactment Act. This article provides details on the legislation, which provides an additional $484 billion for COVID-19 relief, focusing primarily on small businesses and health care. The law also expands eligibility for disaster loans to agricultural enterprises.

The SBA Paycheck Protection Program (PPP) is designed to provide a direct incentive for small businesses to keep their workers on the payroll during this unprecedented time. If your business has been affected by COVID-19, you could be eligible for the SBA PPP loan.

Funding for the PPP loans in the first round lasted 14 days. The second round of funding was approved April 23, 2020, and due to incredible demand, funds could be exhausted very quickly.

If you haven't applied yet and are interested, view the Application Guide below to view the documents needed to begin processing your application!

Economic Impact Payments (Stimulus Check)

In March, Congress passed - and President Trump signed into law - the CARES Act, a $2 trillion economic relief package to provide assistance to American consumers and businesses struggling as a result of the coronavirus pandemic. A provision of the law includes sending government payments to eligible Americans. To help answer questions about these payments, the American Bankers Association has developed the following questions and answers:

How large a payment will I receive??

The CARES Act outlines the parameters of who is eligible to receive a payment. The Internal Revenue Service is the agency responsible for determining eligibility. In general, single adults with an adjusted gross income of $75,000 or less will get $1,200. Married couples earning a combined adjusted gross income of $150,000 or less will receive a total of $2,400. Individual and married taxpayers earning over $75,000 and $150,000 respectively will get reduced payments with full phase-outs at $99,000 and $198,000. There are additional $500 payments for dependent children.

For complete eligibility information please visit the

IRS website.

Will college students be eligible to receive a payment?

The CARES Act definition of eligible individuals excludes those who are claimed as a dependent on another taxpayer’s return. Accordingly, to the extent a college student is claimed as a dependent on the tax return of a parent, he or she would not be eligible for the rebate. For complete eligibility information please visit the

IRS website.

When will I receive my payment?

The Department of the Treasury began sending the payments to consumers across the country on April 15. If you filed taxes in 2018 or 2019 and included your bank routing and account number for payments or refunds, and this information has not changed, the IRS has the information it needs to send your payment electronically. In addition, for Social Security recipients, the IRS will use direct deposit by the Social Security Administration to facilitate payments. If the direct deposit information you have provided in the past is for a bank-issued prepaid debit card, you will receive your funds on that card account. You can check the status of your payment by visiting the IRS’ “

Get My Payment” web tool. Recipients will be mailed a check if the IRS does not have your information on file. Check payments will follow weeks or possibly months after the direct deposits are sent.

Can I receive my payment electronically if my current information is not on file with the IRS?

The IRS is offering a web portal called “

Get My Payment” where you can check the status of your information and your payment. In addition, the IRS has launched a

web tool allowing quick registration for those who don’t normally file a tax return. For the most up-to-date information, visit

IRS.gov/coronavirus.

What if I am typically not required to file a tax return?

People who typically do not file a tax return and are not Social Security beneficiaries will need to file a simple tax return to receive an economic impact payment. Certain low-income taxpayers, veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax.

IRS.gov/coronavirus will soon provide information instructing people in these groups on how to file a 2019 tax return with simple but necessary information, including their filing status, number of dependents and direct deposit bank account information. As noted above, Social Security recipients who have not been required to file tax returns will not be required to file a tax return to receive their payments.

What is a bank routing and account number?

Bank routing and account numbers direct payments to the right bank account at the right financial institution. If you have a checking account at a financial institution the information is on the paper check. The bank routing number is on the lower left-hand side of the check and tells Treasury the correct bank to send the payment. Your individual account number is to the right of the routing number. That tells the bank to credit your specific account. Bank-issued reloadable prepaid debit card accounts have the same numbers, but the way they are provided to you will vary.

How do I find this information if I can't find my checkbook or was never issued any checks at all?

Log in to your bank account online or by mobile app. Bank routing and account numbers may be located in different places in your app or online if you are logging in from a laptop or PC, depending on your bank. If you can’t find it easily, search “bank routing” within the app or website. If you still can’t find the information or can’t log on, call your bank for more information. You can also look up your bank’s routing number at

aba.com/routingnumber. Please remember that to protect your finances from fraudsters, banks will not provide your account number over the phone.

I have a reloadable prepaid card with a bank. Can I direct the payment to that account?

Yes, follow the same instructions to gather the routing and bank account numbers to provide via the IRS online portal.

I have a bank account. Can I still receive a paper check?

Yes, but be aware that your payment will be slower than an electronic transfer. Paper checks may be sent out weeks after the electronic checks are sent. If you are willing to wait, we recommend that you deposit the check through remote deposit capture, if your bank offers this service. This is basically taking a picture of your check through your bank’s smartphone app. Follow the simple directions and you can make the deposit from the comfort and safety of your home the same day the check arrives in the mail. Alternatively, you can make the deposit at your bank’s ATM. The important thing to remember is that with branches closed or restricted, you may be required to visit a bank drive-through location if you want to deposit the check in person.

I don't have a bank account, but want to receive my money faster. What can I do?

Many banks open accounts for most customers online without you ever needing to step into a bank branch. That is important because most bank branches are restricting access due to coronavirus concerns. Search online for banks that offer digital account opening, and reach out to banks to see if they are offering new, flexible ways to become a customer. One type of bank account that accepts direct deposit is a bank-issued reloadable prepaid card often available at retailers that partner with a bank. Please make sure that the card is “reloadable” in order to receive direct deposit. When the account is open you will have the bank routing and account number to provide to the IRS. Please check with the bank you are working with to understand all of the terms and conditions of opening an account.

What can I do to prevent fraudsters from accessing my funds?

There will be a large amount of funds disbursed to qualifying individuals. Accordingly, there is a risk for fraud of various types. The IRS has announced various ways individuals can be on guard against these types of bad activities. See the

notice. It is important to remember that banks or the federal government will never contact you by telephone, text or email asking for your account information. Do not provide any banking information to anyone claiming to be registering you for your relief payment.

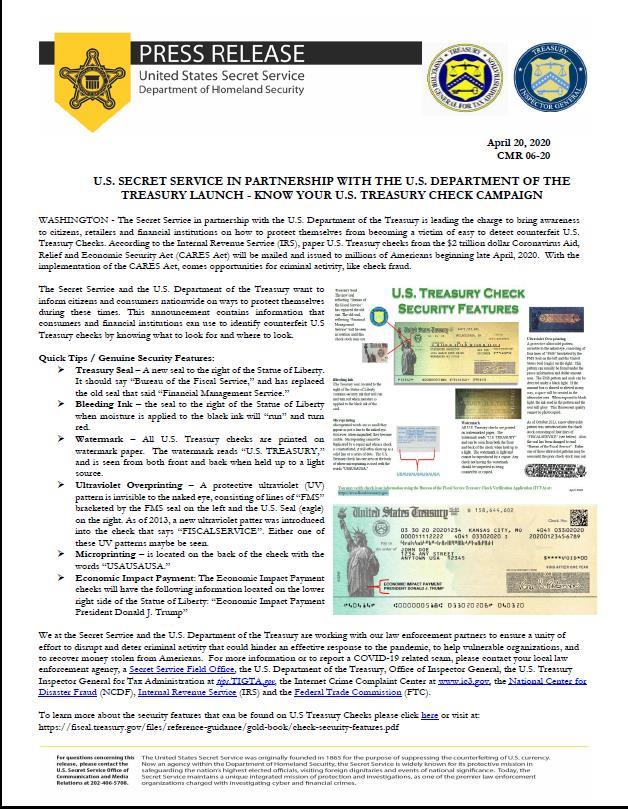

In addition to these Q&A by the American Banker Association, the United States Secret Service, in partnership with the U.S. Department of Treasury, is bringing awareness on how to protect yourself during these times, especially as it concerns the Treasury checks. View the information by clicking on the image below:

Safety Measures

When a disaster strikes, every consumer should know their bank is prepared, their deposits are safe, and they will have continued access to their funds. Farmers State Bank is required by law to have an extensive disaster recovery plan in place to protect customer accounts, and state and federal regulators routinely examine each bank on their preparation.

Service Continuity

Our lobby is currently available by appointment only; however, we are fully operational and ready to assist you via our:

Drive-Thru

- Perform all of your banking operations through the convenience of our drive-thrus

Smart Deposit ATMs

- Make deposits - cash and checks!

- Get cash

- Check your balance

Mobile Banking

- Download the "Farmers State Mobile Banking" App

- Mobile deposit of checks

- Transfer money

- Balance inquiries

Online Banking

- Call 217-285-5585 to enroll

- Transfer money

- Balance inquiries

- Open a DDA account here

- Start a loan application here

Below are step-by-step video tutorials of each of these services.

Please call your branch if you need access to your lock box or to meet with a banker or a loan officer.

Pittsfield: 217-285-5585

Winchester: 217-742-9505

White Hall: 217-374-2200

Jerseyville: 618-498-2299

Hull: 217-432-8311

If your needs require an appointment at one of our branches, please know that we are doing everything we can to keep our facilities germ-free. We’ve increased the frequency of cleanings so that we are disinfecting surfaces throughout the day in addition to having the offices cleaned thoroughly at night.

The CDC is recommending that everyone practice "social distancing" to slow the spread of the virus. We want to remind our customers that many of the services you receive in our branches can also be done by phone, online, mobile or at one of our many Smart Deposit ATMs.

Your Health Matters!

Here’s what we are doing to protect the health of you and your loved ones:

- We have designated multiple “clean rooms” within our facilities for scheduled appointments and meetings. These rooms will be deep-cleaned after every single meeting within the rooms

- Frequent deep-cleans of the facilities in addition to regular nightly cleanings

- Tellers are wearing gloves when handling money to protect your health and wellness

- Virtual meetings with employees and customers

- Vigilant hand-washing to eliminate the spread of germs

- Propping doors open to eliminate touching door handles

What you can do to help prevent the spread and stay healthy

- Wash your hands often with soap and water for at least 20 seconds or use a hand sanitizer that contains at least 60% alcohol

- Avoid touching your eyes, nose or mouth with unwashed hands

- Avoid contact with people who are sick

- Stay home if you are sick

- Cover your cough or sneeze with a tissue or elbow and throw used tissues in the trash

- Clean and disinfect surfaces and objects frequently

- Practice social distancing

- Do not attend events or visit places with large crowds, especially if you are over 60 and have certain underlying health issues

- Reduce activities such as handshakes and maintain an appropriate distance from others during conversation

- Do not share drinks or food with others

Please continue to check our website and social media pages for updates.